We are in the midst of one of the largest stock market booms in recent history – it pays to keep this in mind.

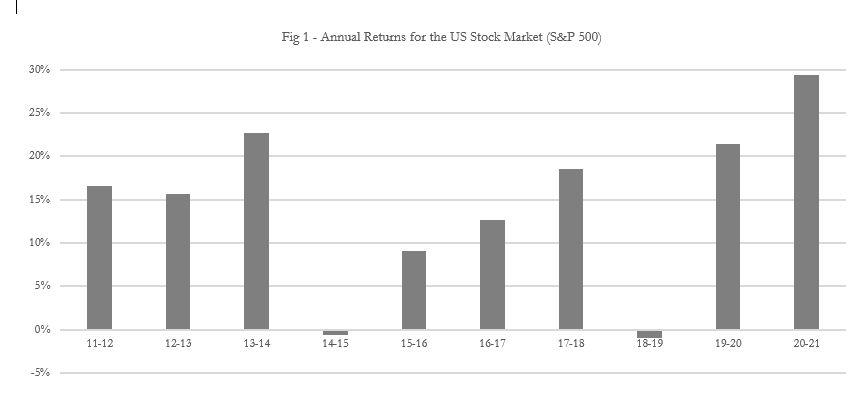

A rising tide lifts all boats. The US stock market is up 35 percent since this time last year, and in the previous year it was up just over 20 percent (fig. 1). It is against this backdrop that the financial markets have seen an influx of new investors and traders (who we would call ‘retail investors/ traders’) looking to make some money during lockdown. It can be easy to be tricked by these market conditions into believing you can’t put a foot wrong when investing, but there are plenty of reasons to remain sensibly cautious.

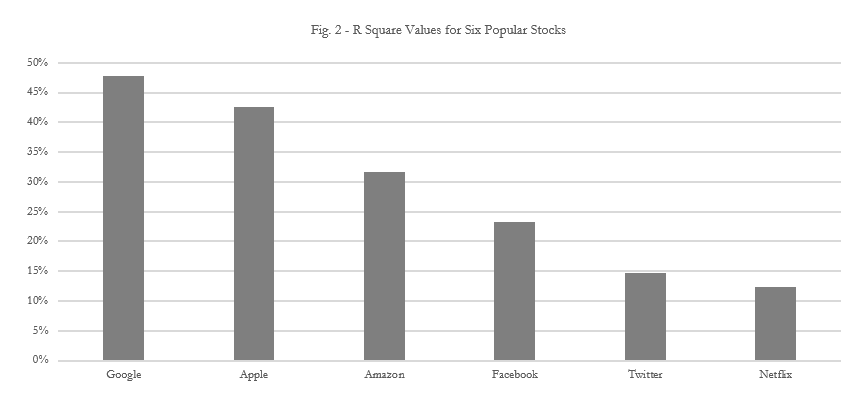

The market is often up or down on a given day based on how the average investor is feeling. Something scary in the news? The market is probably down. A new trade deal was announced? The market is probably up. Day-to-day, your stock holdings will likely fluctuate in value based on these same ideas; this is normal. What’s interesting to see is how much of a stock’s price performance can be attributed to the wider market’s movements and how much is based on actual optimism (or pessimism) about the company specifically.

We have a tool for just this: we call it R-squared (R2). For example, if company XYZ plc has an R2 value of 5 percent, then we say that 5 percent of the movement in XYZ plc’s stock price can be explained by simply the wider market moving. Let’s look at some of the most popular stocks on Trading 212, an online brokerage (fig. 2). Interesting right? Some of the most popular stocks that retail traders hold have seen a substantial portion of their stock price performance driven by nothing but general market sentiment.

What are we to make of this? It should give us pause and a chance to check our hubris. While we may well be seeing healthy returns now, this is likely not due to our exceptional stock picking skills, but rather, we are riding a wave of positive market sentiment which is lifting all stocks. The real challenge is when the market turns downward since, as we’ve seen, that will likely drag your stocks down with it. If you make money during a downturn, that’s when you have earned some bragging rights.

Let’s finish with a discussion on the fear of missing out. We all see those adverts on YouTube or posts on TikTok which promise to teach us how such and such made one million dollars from just one hundred following his plan – which he will happily sell to you if only you’d click on the link to his free online course! It’s important to know that these people are typically either lying or lucky. If your trading strategy was going so well, why would you share it with millions of people, just so they can all compete with you to implement it? Rule one of trading is when you find a strategy, keep it quiet, because once it’s out there it will no longer work. Be suspicious of people handing theirs out, they may well just be lying to you.

So, what about the lucky ones? We often forget that the stock market is a two-way street; every time you buy a stock, someone else has sold it. Typically, this means that when someone wins big, someone else loses big. It has been shown repeatedly that it is very difficult to consistently get higher returns that those seen in the wider market. If a trader, especially a new trader, begins boasting about his returns, it could very well just be that he is one of the lucky ones; his trading strategy is just noise and in the long run will settle down to the normal returns most people make.

Do not mistake bluster and salesmanship for experience, knowledge, and insight. High risk strategies may well bring you big returns, but you will also suffer big losses. The best advice out there is to be sensible, invest consciously in what you know and what you believe in and above all else, if something seems too good to be true, it probably is.

Photo credit: Wikimedia Commons