The global battle with COVID-19 has forced governments around the world to borrow more to keep their economies moving. The United States alone has increased its net debt as a percentage of GDP from 84% in 2019 to 107% as of October 2020 according to the International Monetary Fund (IMF). In

the UK we have seen our net debt to GDP ratio soar from 75% to 98% as the government has rolled out extensive furlough schemes to subsidise worker’s wages during both lockdowns.

Amongst economists, high public debt levels have always been concerning as common wisdom dictates that increasing debt levels lead to more money entering the economy than can be effectively absorbed, and so with more money chasing the same number of products, prices tend to rise. However, new thinking from economists seems to be saying that elevated debt levels may not be as bad as we previously thought.

In 2019, the former Chief Economist of the IMF, Olivier Blanchard, gave a speech to the American Economic Association in which he outlined a simple, yet novel approach to public debt. He noticed that, at least over the past 70 years, the rate of interest that developed nations pay on their debt has been lower than their economy’s growth rate, and so if these governments were to keep all future borrowing in check, a country could effectively grow its way out of debt without any fiscal cost (i.e. on tax intake) and little negative impact to citizen welfare.

Blanchard was quick to point out, however, that if historically low interest rates were to rise again and overtake the growth rate, then of course, a country would need to take other measures to keep their debt under control. However, if the future is like the past then these new higher levels of public debt may be more sustainable than we currently think.

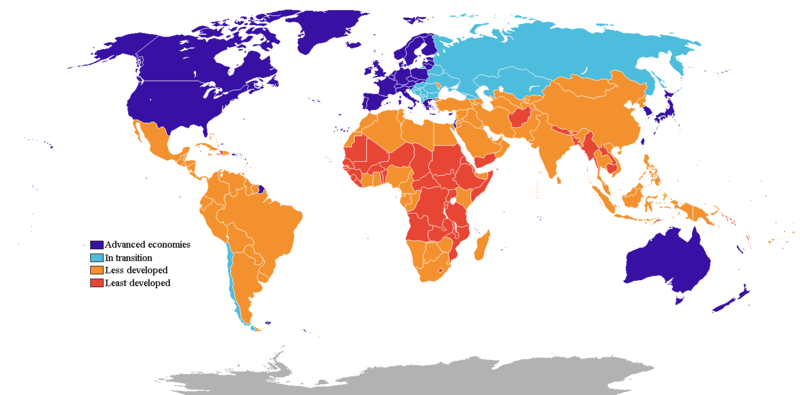

This new style of thinking seems to be good news for indebted governments, but we must recognise that not all nations fit the assumptions needed for Blanchard’s conclusions. Developing nations are also seeing their net debt spike – Chile’s net debt to GDP ratio has nearly doubled in one year and Mexico has seen a 26% jump – however these countries do not have such a long track record of successful borrowing and so aren’t trusted by investors as much as developed nations. Because of this, most developing nations are forced to pay much higher interest rates on their debt to offset the risk to their lenders. As a result, these nations aren’t so lucky as to be able to simply grow their way out of debt.

As is obvious, with more debt comes a higher burden of interest payments. Couple this with the interest rate disparities between countries and it’s not hard to see why we may expect the financial cost of the pandemic to hurt developing nations more than their developed counterparts. With both

public and academic consensus shifting towards a sulphurous attitude towards austerity, all nations face a difficult job in paying down their debt, yet developing nations will suffer the most.

All of this, as Blanchard points out, only holds if interest rates stay low. Rates tend to stay low when there is demand to save, since bank accounts and bonds don’t need high interest rates to convince people to use them. We still don’t know why interest rates are so low, but one can imagine that should interest rates begin to rise again – either because of some unknown factor or because developed nations, who have a better handle on their debt, decide that their economies are strong enough to manage a rate rise from their central banks – then the interest burden on all governments, but

especially those of poorer countries would intensify.

General sovereign default rates, according to the Bank of England and the Bank of Canada, have been pleasingly low in recent years, this is good news as a better credit history for these developing nations can only help them secure less onerous debt in the future. Let us hope that COVID-19 hasn’t

hindered that progress.

Image: Wikimedia Commons